Exploring the different types of loans can be a daunting task if you don’t know where to start. From personal loans to auto loans, there are many loan options available that come with their own set of pros and cons.

To help make your decision easier, here is an overview of some of the most common loan types and their associated benefits and drawbacks. Weighing these factors carefully can help you decide which option is best for you.

Title Loans

Pros: Title loans are easy to qualify for and usually come with shorter repayment terms than other kinds of loans, making them a good choice if you need money fast. In fact, you can apply for car title loans completely online. These loans also don’t require any credit checks, so even those with poor credit may be able to get approved.

Cons: Title loans come with very high-interest rates that make them incredibly expensive over time. Additionally, title lenders can take possession of your vehicle if you default on the loan, which could leave you without transportation.

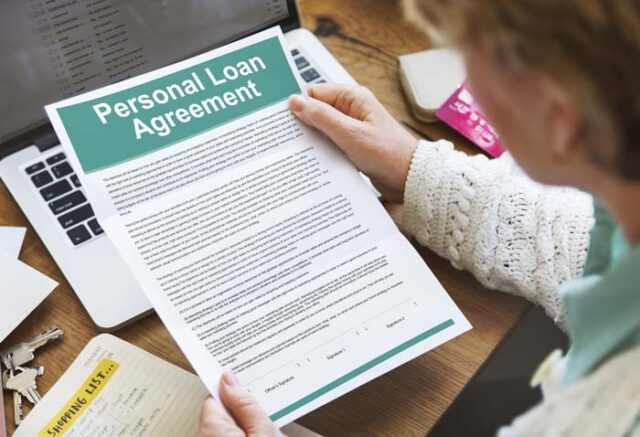

Individual Loans

Pros: As personal loans are frequently unsecured, they don’t need to be backed by property like a house or car. This implies that even if you default on the loan, you won’t lose your assets. Personal loans are an excellent option if you want to save money because they frequently have cheaper interest rates than other types of loans.

Cons: Compared to other loan kinds, personal loans are often more difficult to qualify for, and approval frequently depends on a strong credit history. Also, the periods of personal loans might vary from six months to five years, which might not be suitable for everyone’s needs.

Mortgage Loans

Pros: Low-interest rates on mortgage loans make them more affordable in the long run. Mortgage lenders will normally consider your income and assets in addition to your credit score when determining whether you qualify for the loan. This facilitates the approval of mortgage loans for persons with poor credit.

Cons: Mortgage loans frequently need a sizable upfront down payment, which some people may find difficult to afford. Furthermore, mortgage loans have lengthy payback terms that might run up to 30 years, which means you’ll be repaying the debt for a considerable amount of time.

Car Finance

Pros: Car loans often have shorter repayment terms and are easier to qualify for than other forms of loans (typically three or four years). The car itself is a collateral for an auto loan, so if you can’t make your payments, the lender will seize the vehicle.

Cons: Compared to other loans, auto loans often have higher interest rates, making them more expensive overall. Also, to qualify for the loan, vehicle lenders could insist that you buy particular insurance coverage.

Loan Repayment Terms

This refers to the length of time a borrower is given to repay his or her debt. The actual length of repayment terms vary according to the type of it, as well as the borrower’s credit score and income. Generally, borrowing institutions will offer a variety of loan repayment terms ranging from six months up to 30 years, depending on what you need.

It is also important to understand there are various other factors that can affect debt repayment terms such as fees charged by the lender, any discount points you may have taken on your interest rate and any private mortgage insurance you may be required to pay on certain loan products. Borrowers should therefore carefully consider all their options before deciding what type of loan and repayment period would best fit their needs.

Loan Forgiveness Programs

These programs provide an alternative inflow of debt relief that allows individuals to receive partial or complete loan discharge due to their involvement in certain activities. These activities may include volunteering, working in underserved areas, teaching remote and financially challenged populations, or service in the U.S. Armed Forces. Fortunately, loan forgiveness programs are offered by multiple lenders, including the federal government and many private lenders.

On the flip side, some federal loan forgiveness programs may be limited due to limits on how much debt can be forgiven and restrictions on who can qualify and when they can qualify set by the lending institutes or organizations offering these programs. This can result in some eligible candidates getting excluded due to stricter guidelines mandated by the lender or organization providing these services.

Interest Rates

The interest rate of it is the cost that the borrower pays to borrow the money. It is usually expressed as a yearly, or annual, percentage rate (APR). The total cost of it depends on the interest rate, how much you borrow, and other fees and terms associated with it. With most loans, a higher percentage means a higher cost for the borrower.

There are two types of interest rates: fixed-rate and variable-rate. A fixed-rate has an interest rate that remains stable throughout the term of it, regardless of changes in market conditions. A variable-rate loan’s interest rate can change over time – typically according to an index such as LIBOR (London Interbank Offered Rate). Depending on which type of loan you choose and what type of credit history you have, your APR can range from 3% to 35%.

It is important to weigh your options carefully when selecting a lender for your loan. Shop around and compare different offers to ensure you are getting the best deal for your needs. Some lenders may offer ones with lower interest rates, but may also come with costly fees or unfavorable terms if not thoroughly researched in advance. Make sure that you understand all the details associated with each offer so that you feel comfortable making an informed decision.

In Conclusion

It is essential to weigh the benefits and drawbacks of different loan options before settling on one that best suits your needs. Doing your research ahead of time and taking note of the terms and conditions associated with each option can help ensure that you make an educated decision about which loan will work best for you. Taking out a loan should never be taken lightly, so make sure you have all the necessary information to feel confident in making this important financial decision. With careful thought and consideration, you can secure yourself financially now and for the future.