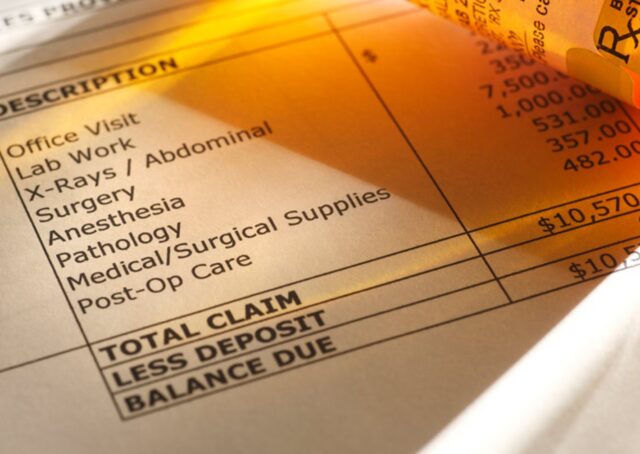

If you’re in a car accident or hurt in some way, you may face extensive medical bills. Even with health insurance, you may be responsible for a fair amount of out-of-pocket costs.

It can be scary to be saddled with these bills and wonder how you’re going to pay them. Often after even a seemingly minor injury, it seems like the bills just don’t stop. This is especially true since each provider, even when working for the same hospital or clinic, will often bill separately as an independent contractor.

If you feel overwhelmed or like you’re in over your head, what should you know about who covers the cost of medical expenses after an accident?

What to Know First

According to Hirsch & Lyon Accident Law, if you’re injured in a car accident, and it’s not your fault, then ultimately the other driver should be responsible for your medical bills. That would mean through their car insurance, your medical bills should be covered if someone else is at fault.

If this is the case, the insurance of the other driver isn’t going to directly pay your doctors, nor are they going to reimburse you each time you visit the doctor.

Also, it can be complicated because settling with the insurance company of the other driver can take months or even potentially years. Some of this timeline is going to depend on the severity and extent of your injuries.

Your doctor or provider isn’t likely going to wait for the insurance settlement, so that means if you don’t pay the bills as you receive them, you might be sent to collections.

That’s where your insurance should come into play.

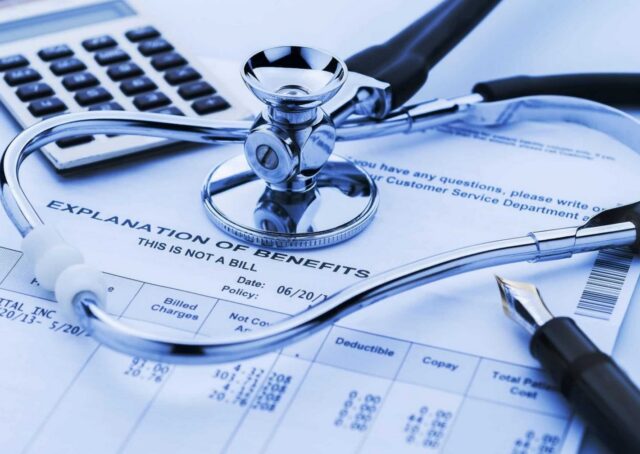

If you have health insurance, Medicaid, or Medicare, you should first submit your medical bills to them, even if you were hurt in an accident where someone else was atfault.

You might also have Med Pay coverage as part of your own car insurance, in which case you can use this to cover out-of-pocket costs that remain after health insurance has paid its part. For example, you might use Med Pay to cover your co-pays or deductibles.

If you’re in a state where personal injury protection is common, then that might be the primary insurance that covers your medical expenses following an accident. If you have PIP coverage and the cost of your medical goes beyond the limits of that, then your health insurance should pay the rest.

If medical costs cause financial hardship, you may be able to reduce what you owe. Eligibility is often based on things like income limits.

Whose Fault Is It?

The concept of fault is an important part of understanding who pays your medical bills after an accident. If you are in an accident with someone else, in order for fault to be established, you have to show that someone else’s actions were negligent or intentional and that those actions then led to your injuries.

If you were hit by someone, for example, and they were on their phone at the time, that is negligence and they should be responsible for covering your damages. Your damages include your medical bills.

Other examples of easily provable negligence in car accidents include driving under the influence, speeding, or running a red light. Those are situations where the other driver is violating traffic laws, so it’s going to be their fault if they caused an accident while doing so.

Other liable parties can include the other driver’s employer or your local government.

In the instance of the other driver’s employer, the driver would have to have injured you while acting within the scope of their employment. For example, if you’re in an accident with someone who’s working as a delivery driver, their employer might have to pay your medical expenses.

If you’re hurt because of a big pothole, then the local government might be at least partially liable for your injuries.

The issue when figuring out who pays your medical bills if you’re hurt in an accident usually comes down to the establishment of fault, and even though you might think it’s clear-cut, it usually isn’t.

When you’re establishing fault, there needs to be evidence collected.

If you decide to pursue legal action after you’re hurt in an accident, you can gather evidence during the discovery phase. An attorney can help you figure out the best way to gather all the needed evidence to prove fault.

You can only recover compensation if you can show damages stemming from the accident, which can include medical bills and also the cost of any potential future medical expenses. Other types of damages include loss of income and emotional distress or pain and suffering.

If you’re in a serious accident, your medical expenses can be long-term and very expensive. For example, there are prosthetic devices that can cost more than $50,000 and have to be replaced every few years.

Therapy visits are another form of long-term care, as is the cost of durable medical equipment if your spinal cord is injured.

To sum up, there’s often a process that’s followed after a car accident as far as how medical expenses are paid. You will likely have to pay some of it out of pocket initially. Then, your health insurance should start to cover expenses once you meet your deductible or co-pay requirements.

After that, if you were in an accident with another driver and you believe they’re atfault, you will need to talk to a lawyer about compensation. A lawyer can come up with a figure for compensation and can also work to gather evidence to show to the insurance company that the other driver was atfault.

The other driver’s insurance company is not likely to automatically cover the costs of your injuries without first going through these steps.

To avoid going to collections, pay your medical bills as you get them, and then you can go through the legal process of reimbursement for these costs.