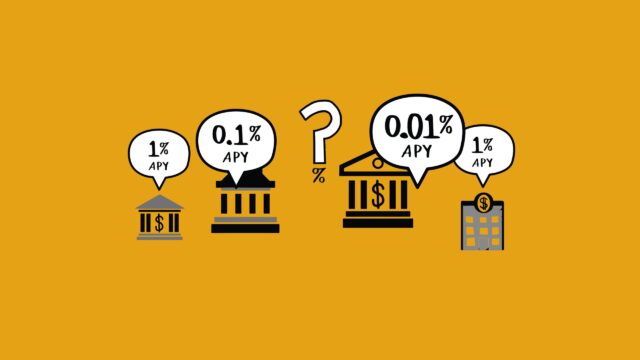

It’s in your best interest to compare savings account interest rates to get the greatest one for you. The success of your savings plans is significantly impacted by the interest rate you receive on your account. Interest rates are highest with online banks and credit unions. Higher interest rates are offered by these institutions because they do not have the same costs as a physical bank.

It’s in your best interest to compare savings account interest rates to get the greatest one for you. It is crucial to shop around for the best rate before deciding where to keep your money stashed. The good news is that the best interest rates are not hard to locate.

To help you get the best rate, we’ve created a list of the best rates from a number of different banks and credit unions.

Types of banks

There are a few main types of banks, which can help you to find the best interest rate for your needs.

The first type of bank is a commercial bank. Commercial banks are usually the largest and most well-known banks in the country. They offer higher interest rates on savings accounts than other banks, but they also tend to have more complicated lending procedures and stricter requirements for opening an account.

The second type of bank is a savings and loan association (S&L). Savings and loan associations were the original bank-type institutions in the United States. They offer lower interest rates on savings accounts than commercial banks, but they also offer more lenient lending policies and more customer service.

The third type of bank is a credit union. Credit unions are specialized financial institutions that are owned and operated by their members (usual employees of member businesses). They offer high-interest rates on savings accounts, but they also provide many other beneficial services, such as same-day checking deposits and no fees for making loans or withdrawing cash.

Finally, there are online banks. Online banks are regulated by the federal government as depository institutions, which means that they can offer higher interest rates on savings accounts than traditional brick-and-mortar banks.

Bank With Highest Interest Rate Singapore

Deciding on a reliable bank is crucial. You should look for a financial institution that excels both in terms of interest rates and customer support. There is a wide variety of financial institutions in Singapore. Okay, but which one is the top pick?

The bank with highest interest rate in Singapore can be found by doing research. It’s no secret that banks in Singapore offer some of the highest interest rates in the world. But with so many different banks to choose from, how can you be sure you’re getting the best deal? Here are a few tips to help you find the banks with the highest interest rates in Singapore:

Do Your Research

Before you open an account with any bank, it’s important to do your research and compare interest rates. There are a number of websites that can help you with this.

Ask Around

If you have friends or family who live in Singapore, ask them which banks they use and whether they’re happy with the interest rates they’re getting.

Consider Your Needs

When you’re choosing a bank, it’s important to consider your own needs. For example, if you’re a student, you might want to look for a bank that offers student discounts or offers free withdrawals.

Find Out the Monthly Interest Rates of The Best Banks

Finding the best interest-rate bank is essential if you want to put money away. Since bank interest rates are always fluctuating, keeping up with them can be challenging. But there are a few strategies to get the lowest prices. Go online and look up the current interest rates. The interest rates of most banks can be found online. You can also look at websites that compare interest rates to see what other banks are offering. You can check current interest rates by calling several financial institutions. If you need help locating a specific financial institution, this is a viable choice. Also, you can always go to the bank branches themselves. The easiest approach to compare rates is to visit multiple banks, speak with representatives, and form an impression.

How to calculate bank interest rates?

When calculating bank interest rates, accountants and bankers often use a variety of factors to come up with an estimate. These can include the current rate offered by the bank, how long the loan has been outstanding, and the credit score of the borrower. However, one of the most important factors when calculating interest rates is the term length. This is because shorter-term loans tend to have higher interest rates than longer-term loans. For example, if you take out a loan with a term of five years, you’ll be charged a higher interest rate than if you took out a loan with a term of 10 years. This is because lenders are more willing to lend money to people who have a shorter repayment period in mind. That said, it’s important to remember that not all banks offer higher interest rates for shorter terms. So it’s always worth checking with your bank before making any decisions.

Fixed Deposit Interest Rate

Find the best bank for a fixed deposit in 2024 by thinking about these factors. You should prioritize selecting an FDIC-insured financial institution. If the bank should ever go under, your funds would still be safe. Finding a bank that gives you a good return on your money is important, so do your research to find the best rate. You should also look for a reputable financial institution with helpful staff members.

Conclusion

If you’re looking to earn some extra money while you save money, now is the time. The highest banking interest rates in history are currently available, and they won’t last long. So what do you need to do to take advantage of these high rates? There’s no secret – just ask for a loan from your bank, and be prepared to put up a good enough down payment that the bank feels comfortable lending you the money. Interest rates vary based on your credit score, so make sure you assess your current financial situation before applying for a loan so that you can get the best rate possible.